8 questions that can tax you while e-filing your returns

Chandralekha Mukerji

By , ET Bureau | Jul 27, 2016, 10.45 AM IST

Chandralekha Mukerji

By , ET Bureau | Jul 27, 2016, 10.45 AM IST

http://economictimes.indiatimes.com/wealth/tax/8-questions-that-can-tax-you-while-e-filing-your-returns/articleshow/53409832.cms

Here are answers to eight commonly asked queries that you were too embarrassed to ask.

Among reasons given by people who missed filing returns in the past is they did not know they were supposed to file tax returns.

1. Have not filed ITR for past two years. Can I file now?

Among reasons given by people who missed filing returns in the past is they did not know they were supposed to file tax returns. Others say they were on a sabbatical and not earning, and hence the gap in their ITRs. Or they were so busy that they simply forgot to file.

Some of these defaulters may have received a notice from the tax department. Others shy away from making amendments as they feel a correction will call for scrutiny and fetch a notice. However, the reverse is true. "It's a myth that those who start filing after a gap will receive notices. In fact, chances of getting a

notice are higher if you do not make corrections," says Archit Gupta, CEO, ClearTax.in.

The tax department does not want to harass a taxpayer who is willing to comply. Through a recent circular, the CBDT gave a chance to taxpayers to

complete pending ITR V verifications for previous six assessment years. You don't have to worry even if you have never filed a tax return or have missed filing in the past couple of years. Make a fresh start this year.

2. What all should I include under interest income?

Here are answers to eight commonly asked queries that you were too embarrassed to ask.

Among reasons given by people who missed filing returns in the past is they did not know they were supposed to file tax returns.

1. Have not filed ITR for past two years. Can I file now?

Among reasons given by people who missed filing returns in the past is they did not know they were supposed to file tax returns. Others say they were on a sabbatical and not earning, and hence the gap in their ITRs. Or they were so busy that they simply forgot to file.

Some of these defaulters may have received a notice from the tax department. Others shy away from making amendments as they feel a correction will call for scrutiny and fetch a notice. However, the reverse is true. "It's a myth that those who start filing after a gap will receive notices. In fact, chances of getting a

notice are higher if you do not make corrections," says Archit Gupta, CEO, ClearTax.in.

The tax department does not want to harass a taxpayer who is willing to comply. Through a recent circular, the CBDT gave a chance to taxpayers to

complete pending ITR V verifications for previous six assessment years. You don't have to worry even if you have never filed a tax return or have missed filing in the past couple of years. Make a fresh start this year.

2. What all should I include under interest income?

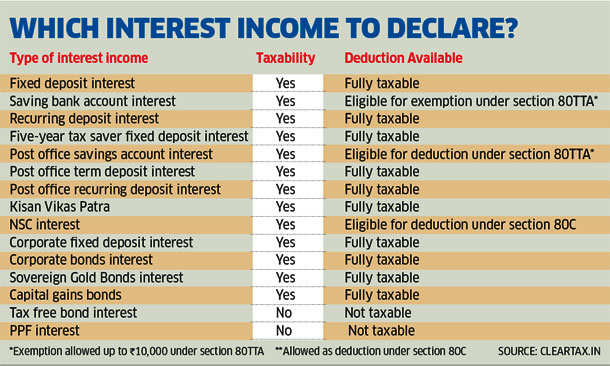

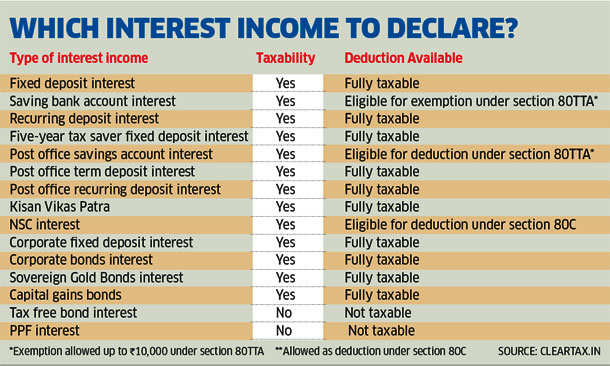

All taxable interest income needs to be declared in your ITR! Remember this one simple rule and you will never make a mistake. To know which all interest

income are taxable, refer to the table.

The confusion often arises because some of of the taxable interest income, like interest on NSC and interest earned on savings account in bank or post office are eligible for deduction. But you need to declare these incomes too and then claim the deduction under a separate section to reduce your tax liability. While investment in five year FDs are eligible for tax benefits, the interest earned on it

is fully taxable.

3. Do I need to report all my bank accounts?

Last year, the government made it mandatory to list all bank accounts in the ITR form. A common query is whether one needs to report every single account

including those that are no longer active. The answer to that question depends on how long the account has been inactive. "It is not compulsory to provide

details of accounts which are dormant. So, one can omit giving details of those accounts which have been inoperational for the past 36 months, since those are considered dormant," says Gupta.

RBI norms say an account becomes dormant if a customer does not initiate transactions such as withdrawal of cash at a branch or ATM, cheque payment, transfer of funds through Netbanking, phonebanking or ATMs.

An account is called inactive if it is not used for 12 months and has to be listed.

If you get dividends or the proceeds of your fixed deposit, the account is considered operational even if you haven't deposited or withdrawn cash. It will

be treated as inoperative only after two years from the date of the last credit entry provided there is no other customer induced transaction.

4. Is it necessary to provide Aadhaar card details?

While it is not mandatory to provide your Aadhaar details, it is good if you link the two. For one, your everification process for ITR V becomes easier.

However, before you link, make sure that your Aadhaar and PAN card details match. In case they don't, save the task for later. A mismatch in the two

documents can create unnecessary complications.

5. Which is the correct address to provide in ITR?

It is not uncommon to have three to four different addresses quoted at various places. Addresses in your voter's ID, bank account, Aadhaar card and PAN

records may not match and all be different.

Some of you may even have office addresses in your bank records. Which address should you provide in your ITR? Technically, you could provide any.

The incometax department now corresponds over email and text messages and any communication from them would be delivered to you electronically.

However, some taxpayers still have been receiving communication over post too. So, to be on the safer, provide an address where you currently receive your

mails. "It is advisable to give address of the place where you currently reside," says Gupta.

6. Why is there a tax due even after TDS was deducted?

Your employer has been deducting tax every month. Even the bank has been crediting interest income after deducting taxes. And you do not have any other

source of income. Yet, the screen shows a tax due. In the case of salary income, this may be because you forgot to declare an additional source of income: say, from a previous employer.

Your employer deducts TDS based on the tax slab you fall, which is based on your annual income. However, if you haven't declared your investments or

your annual income. However, if you haven't declared your investments or income from a previous employer, the calculations go wrong. But at the end of the year, when you add up your income details in your ITR, the calculator shows an outstanding liability.

For those of you, who have a large interest income, the outstanding tax liability is because TDS is deducted at 10%. "Banks do not know your slab and they deduct TDS at 10% from deposit incomes, which may lead to a tax due in your return if you belong to the 20% or 30% tax slab," explains Gupta. Also, savings account interest is not subject to TDS. If you have income exceeding Rs 10,000 from your savings account, you are likely to see a tax due in your return.

7. What to do if I have filed an erroneous return?

One of the advantages of filing your return on time is that you are allowed to revise it any time you want. If you have not verified your ITR V yet, you can just

refile. "If you have discovered an error immediately after filing, it is advisable that you do not verify such a return as your tax processing starts only after ITR

V has been verified," says Gupta. Even if you have verified, you can file a revised return under Section 139(5) with correct particulars.

8. How do I know that ITR has been filed successfully?

If you are filing on the last day, there might be delays as servers are overloaded. So, make sure that you have received an acknowledgement number from the tax department. This acknowledgement is sent on your registered email. Look for an email from DONOTREPLY@incometaxindiaefiling.gov.in with

subject 'Confirmation on Submission of IT Return'. The ITR V is usually attached that states the acknowledgment number. If you do not get this email, it could be that your return was not submitted successfully and you may have to refile.

income are taxable, refer to the table.

The confusion often arises because some of of the taxable interest income, like interest on NSC and interest earned on savings account in bank or post office are eligible for deduction. But you need to declare these incomes too and then claim the deduction under a separate section to reduce your tax liability. While investment in five year FDs are eligible for tax benefits, the interest earned on it

is fully taxable.

3. Do I need to report all my bank accounts?

Last year, the government made it mandatory to list all bank accounts in the ITR form. A common query is whether one needs to report every single account

including those that are no longer active. The answer to that question depends on how long the account has been inactive. "It is not compulsory to provide

details of accounts which are dormant. So, one can omit giving details of those accounts which have been inoperational for the past 36 months, since those are considered dormant," says Gupta.

RBI norms say an account becomes dormant if a customer does not initiate transactions such as withdrawal of cash at a branch or ATM, cheque payment, transfer of funds through Netbanking, phonebanking or ATMs.

An account is called inactive if it is not used for 12 months and has to be listed.

If you get dividends or the proceeds of your fixed deposit, the account is considered operational even if you haven't deposited or withdrawn cash. It will

be treated as inoperative only after two years from the date of the last credit entry provided there is no other customer induced transaction.

4. Is it necessary to provide Aadhaar card details?

While it is not mandatory to provide your Aadhaar details, it is good if you link the two. For one, your everification process for ITR V becomes easier.

However, before you link, make sure that your Aadhaar and PAN card details match. In case they don't, save the task for later. A mismatch in the two

documents can create unnecessary complications.

5. Which is the correct address to provide in ITR?

It is not uncommon to have three to four different addresses quoted at various places. Addresses in your voter's ID, bank account, Aadhaar card and PAN

records may not match and all be different.

Some of you may even have office addresses in your bank records. Which address should you provide in your ITR? Technically, you could provide any.

The incometax department now corresponds over email and text messages and any communication from them would be delivered to you electronically.

However, some taxpayers still have been receiving communication over post too. So, to be on the safer, provide an address where you currently receive your

mails. "It is advisable to give address of the place where you currently reside," says Gupta.

6. Why is there a tax due even after TDS was deducted?

Your employer has been deducting tax every month. Even the bank has been crediting interest income after deducting taxes. And you do not have any other

source of income. Yet, the screen shows a tax due. In the case of salary income, this may be because you forgot to declare an additional source of income: say, from a previous employer.

Your employer deducts TDS based on the tax slab you fall, which is based on your annual income. However, if you haven't declared your investments or

your annual income. However, if you haven't declared your investments or income from a previous employer, the calculations go wrong. But at the end of the year, when you add up your income details in your ITR, the calculator shows an outstanding liability.

For those of you, who have a large interest income, the outstanding tax liability is because TDS is deducted at 10%. "Banks do not know your slab and they deduct TDS at 10% from deposit incomes, which may lead to a tax due in your return if you belong to the 20% or 30% tax slab," explains Gupta. Also, savings account interest is not subject to TDS. If you have income exceeding Rs 10,000 from your savings account, you are likely to see a tax due in your return.

7. What to do if I have filed an erroneous return?

One of the advantages of filing your return on time is that you are allowed to revise it any time you want. If you have not verified your ITR V yet, you can just

refile. "If you have discovered an error immediately after filing, it is advisable that you do not verify such a return as your tax processing starts only after ITR

V has been verified," says Gupta. Even if you have verified, you can file a revised return under Section 139(5) with correct particulars.

8. How do I know that ITR has been filed successfully?

If you are filing on the last day, there might be delays as servers are overloaded. So, make sure that you have received an acknowledgement number from the tax department. This acknowledgement is sent on your registered email. Look for an email from DONOTREPLY@incometaxindiaefiling.gov.in with

subject 'Confirmation on Submission of IT Return'. The ITR V is usually attached that states the acknowledgment number. If you do not get this email, it could be that your return was not submitted successfully and you may have to refile.

You still have to verify your ITR V. You can verify either electronically or mail the signed ITR V to the processing centre within 120 days of filing the return.