Bond Street Action:

Dalal Street in dumps, you can bet on tax-free bonds

By Saikat Das, ET Bureau | 8 Sep, 2015, 10.16AM IST

By Saikat Das, ET Bureau | 8 Sep, 2015, 10.16AM IST

MUMBAI: For the faint-hearted retail investors shaken by the turmoil in the equity markets, there is something to cheer about.

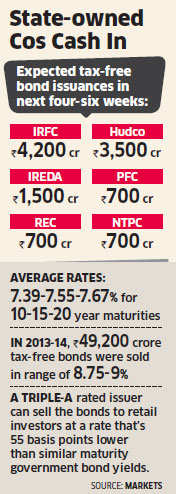

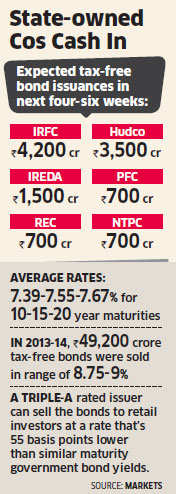

More than Rs 10,000 crore of taxfree bonds from state-run companies such as NTPC, Power Finance Corp. (PFC), Indian Railways Finance (IRFC), Indian Renewable Energy Development Agency (IREDA), Rural Electrification (REC) and Housing and Urban Development Corp. (Hudco) are set to hit the market in the next one or two months, three people familiar with the matter told ET.

On an average, investors can earn as much as 7.39-7.67% in post-tax interest from these bonds with 10, 15 and 20-year maturities, going by the benchmark yield reported two weeks ago.

More than Rs 10,000 crore of taxfree bonds from state-run companies such as NTPC, Power Finance Corp. (PFC), Indian Railways Finance (IRFC), Indian Renewable Energy Development Agency (IREDA), Rural Electrification (REC) and Housing and Urban Development Corp. (Hudco) are set to hit the market in the next one or two months, three people familiar with the matter told ET.

On an average, investors can earn as much as 7.39-7.67% in post-tax interest from these bonds with 10, 15 and 20-year maturities, going by the benchmark yield reported two weeks ago.

The benchmark, 30-share BSE Sensex declined 1.22% to 24,893.81 on Monday, extending the loss since August 7 to 12%. "It would be wise to raise funds via tax-free bonds now as many retail investors may not be looking at underperforming equities and want to lock in long-term debt products at attractive levels with tax efficiency," said Ajay Manglunia, head of fixed income at Edelweiss Securities. "The fad may fade away in the second half of the year with many PSU disinvestments being lined up, which will be attractive to retail."

Most of the companies seeking to raise from such bonds have appointed investment bankers. NTPC, Power Finance and Rural Electrification are looking to raise Rs 700 crore each. Indian Railways Finance and IREDA are likely to raise about Rs 4,200 crore and Rs 1,500 crore, respectively, and Hudco is aiming for Rs 3,500 crore.

"We are trying to tap the retail money as soon as possible, before the market gets crowded out. We would appoint arrangers in a week's time," said a senior official from one of the companies.

Issuers have already mopped up funds via private placements as the government has mandated such sales only to the extent of 30% of the allotted size.

"Retail investors, who are now sitting on surplus funds obtained from maturing high-yielding term deposits or fixed maturity plans, are willing to invest the same in tax-free bonds," said Rupesh Bhansali, head of distribution at GEPL Capital.

Banks are cutting interest rates, leading to lower returns from deposits, and the Reserve Bank of India is expected to reduce the benchmark rate to spur economic growth.

"Tax-free bonds are worth investing, especially when interest rates are likely to dip in the next two years," said Suresh Sadagopan, principal planner at Ladder 7 Financial, an advisory firm.

"Retired people can have steady annual income flow from it while others can invest surplus funds to have additional income." The central bank has cumulatively decreased rates by 75 bps.

Yields have fallen to 7.75% from 8% about four months ago, pushing prices up. A rate cut expectation is also keeping the interest of investors alive.

Most of the companies seeking to raise from such bonds have appointed investment bankers. NTPC, Power Finance and Rural Electrification are looking to raise Rs 700 crore each. Indian Railways Finance and IREDA are likely to raise about Rs 4,200 crore and Rs 1,500 crore, respectively, and Hudco is aiming for Rs 3,500 crore.

"We are trying to tap the retail money as soon as possible, before the market gets crowded out. We would appoint arrangers in a week's time," said a senior official from one of the companies.

Issuers have already mopped up funds via private placements as the government has mandated such sales only to the extent of 30% of the allotted size.

"Retail investors, who are now sitting on surplus funds obtained from maturing high-yielding term deposits or fixed maturity plans, are willing to invest the same in tax-free bonds," said Rupesh Bhansali, head of distribution at GEPL Capital.

Banks are cutting interest rates, leading to lower returns from deposits, and the Reserve Bank of India is expected to reduce the benchmark rate to spur economic growth.

"Tax-free bonds are worth investing, especially when interest rates are likely to dip in the next two years," said Suresh Sadagopan, principal planner at Ladder 7 Financial, an advisory firm.

"Retired people can have steady annual income flow from it while others can invest surplus funds to have additional income." The central bank has cumulatively decreased rates by 75 bps.

Yields have fallen to 7.75% from 8% about four months ago, pushing prices up. A rate cut expectation is also keeping the interest of investors alive.

No comments:

Post a Comment